Newcastle Building Society

The Newcastle Building Society provide mortgages to people in the region and beyond. They currently lend around £575m to their customers. This project aimed to make it easier for customers to renew their mortgage, retain customers, and make efficiencies by reducing customer service calls.

I was the UX lead for this project, and I worked within an agile development team that included a product owner, developers, testers and business analysts. I joined the project halfway through development, but my involvement significantly impacted the service's experience, design, and quality.

I led the research that informed the services flow, content and functionality. I created prototypes, conducted usability testing, advised on accessibility and focused the team on user needs whilst working closely with the business to meet their goals.

DISCOVERY

What information do customers need to renew their mortgage?

I have never had a mortgage myself, so the mortgage renewal process was a bit of an unknown for me. To understand what information customers needed and what they expected, I conducted customer interviews.

The interviews were conducted remotely over a week. The participants were asked about their current mortgage, how they renew it and what information is important to them before committing to a renewal.

Key findings

- Many customers choose to use a broker to renew their mortgage rather than coming directly to a provider.

- The language and terminology surrounding mortgages can be confusing for customers.

- It is hard for customers to understand whether they are getting the best deal.

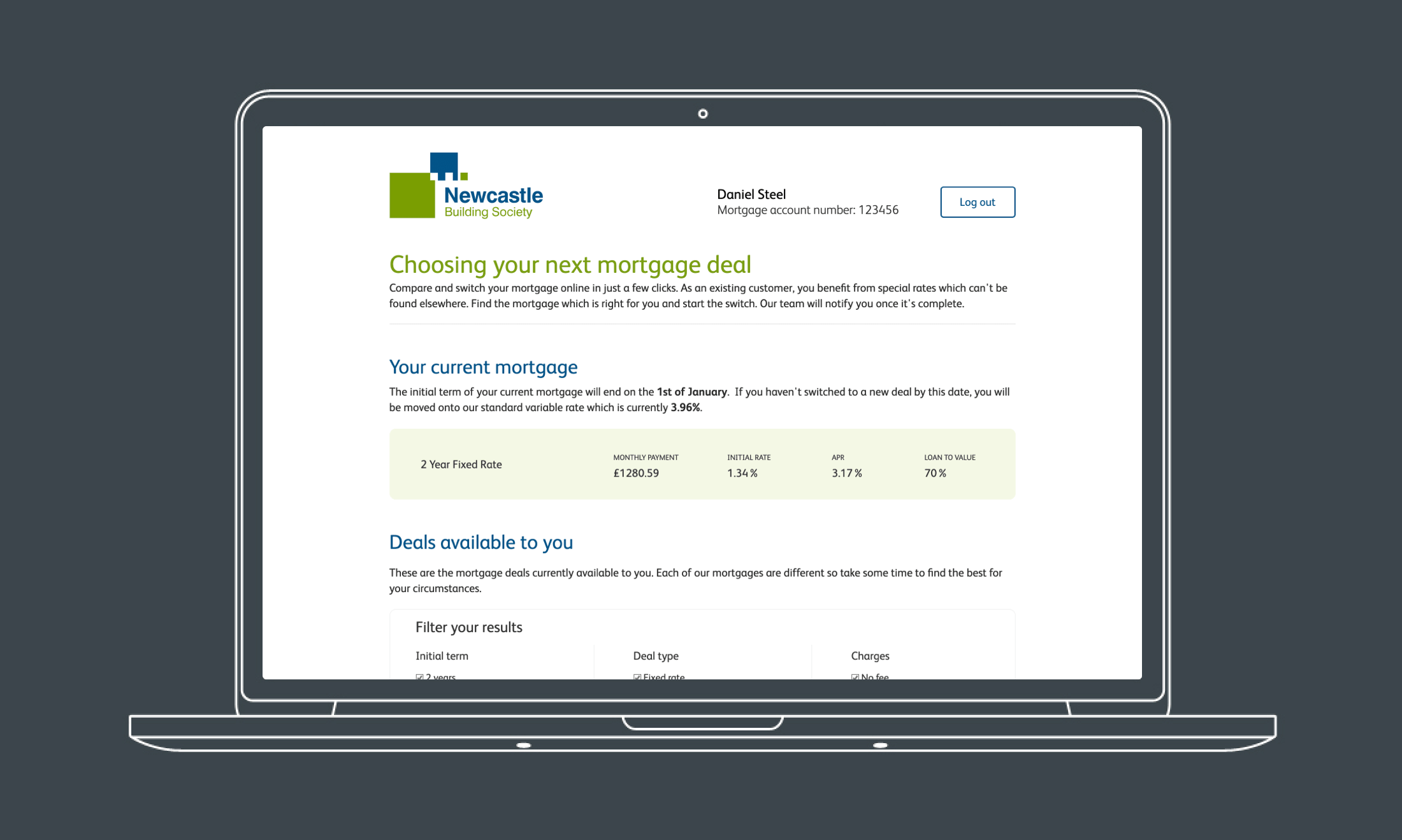

One of the customer interviews via teams.

DISCOVERY

Who is providing a good experience in this area?

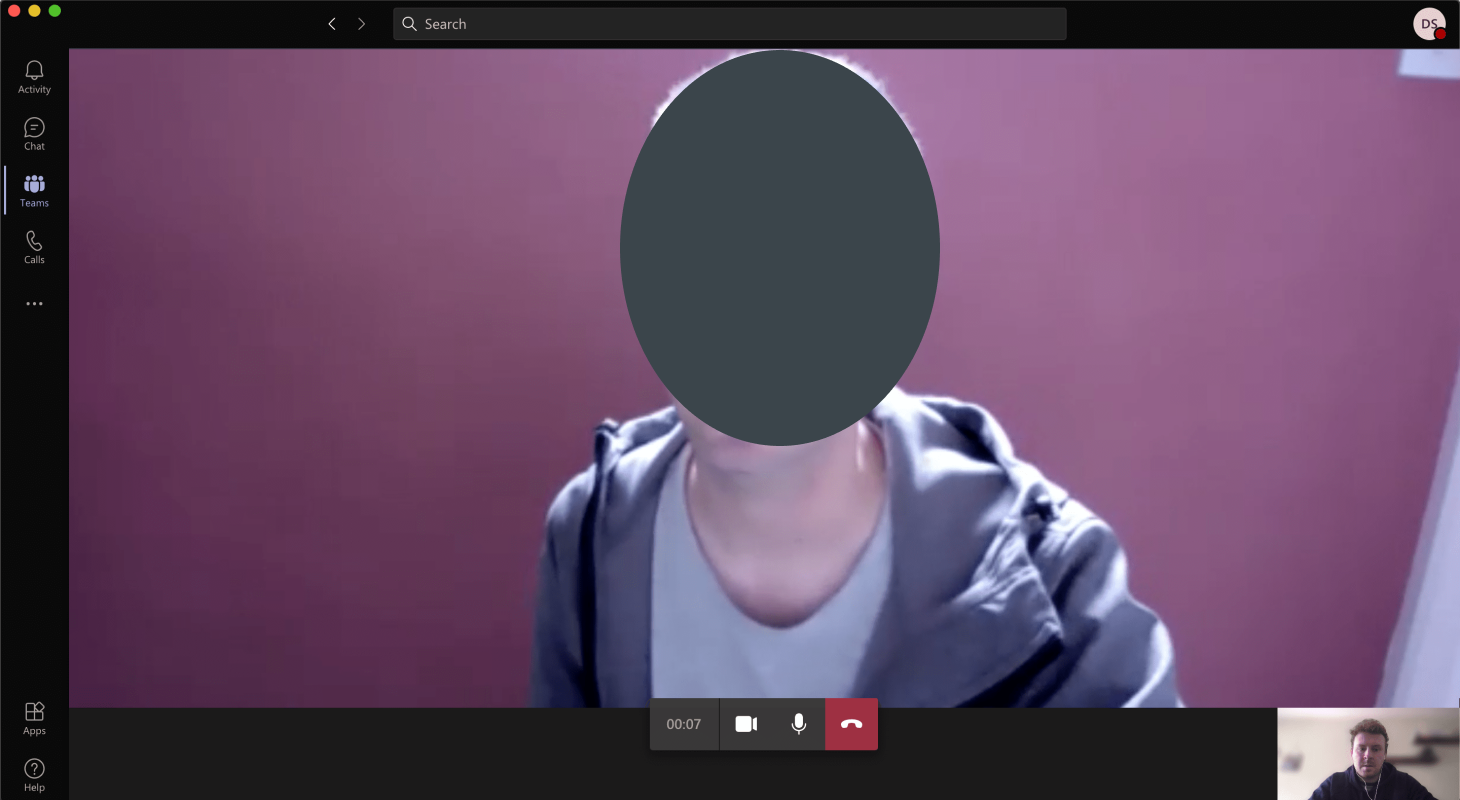

I conducted a competitor analysis to understand what experiences are out there, what good looks like, and what isn't so good. The focus of the competitor analysis was the user journey, content, functionality and interactions. I used MIRO to document and share the findings with the team. MIRO was used as a collaborative space and a central repository for research and artefacts.

A screenshot of the competitor analysis findings in MIRO.

DEFINE

What's in scope?

When I joined the project, development had already begun. There were often many questions in the stand-ups around what is and what isn't part of this project. There was no defined scope or journeys.

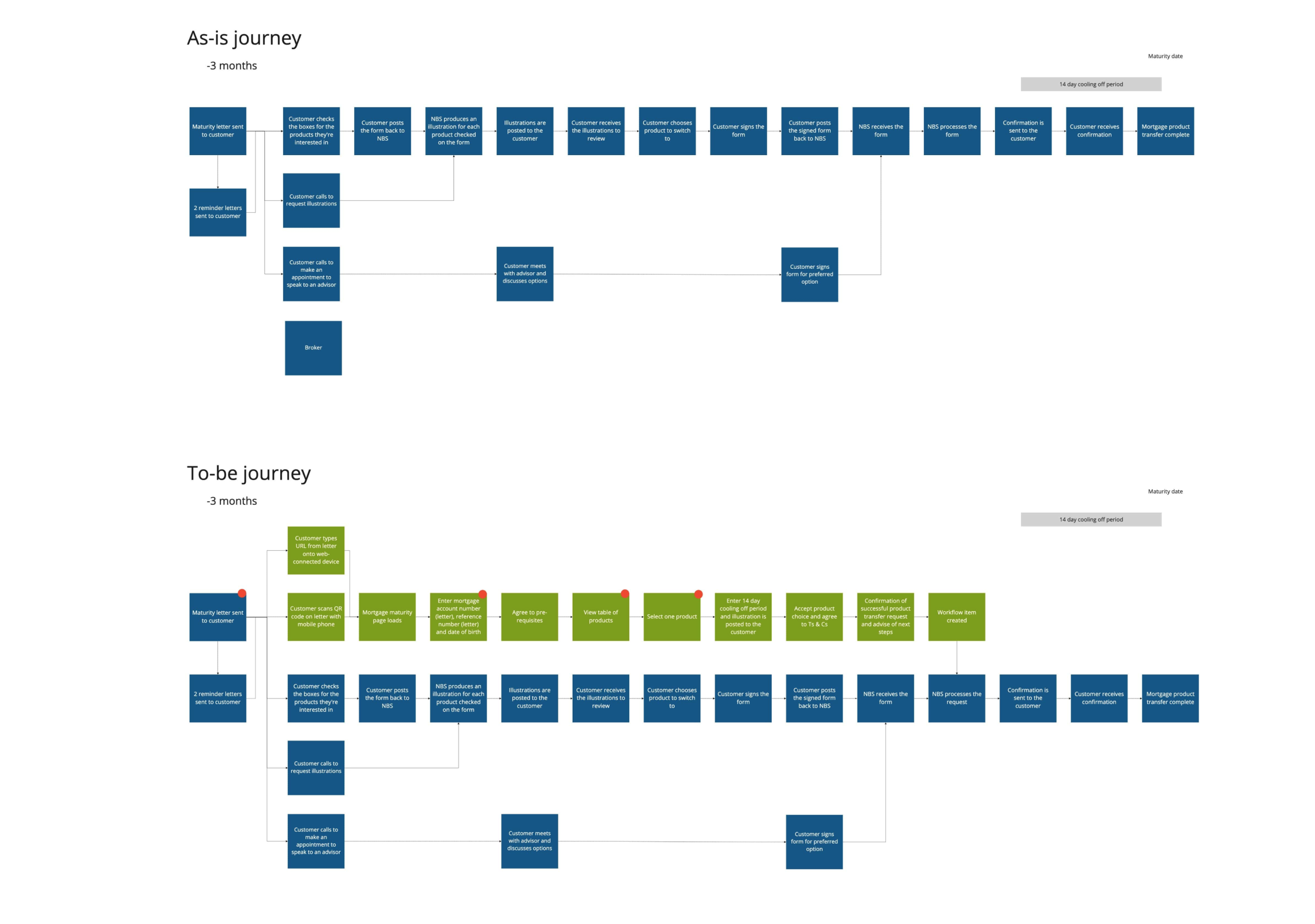

I ran a collaborative session with the project team and representatives from the business to define this project's scope. We mapped the existing journey and determined which part of that journey will be improved by developing this new service.

As a team, we mapped the as is journey and defined the sope of this project.

IDEATE

What should this service look like?

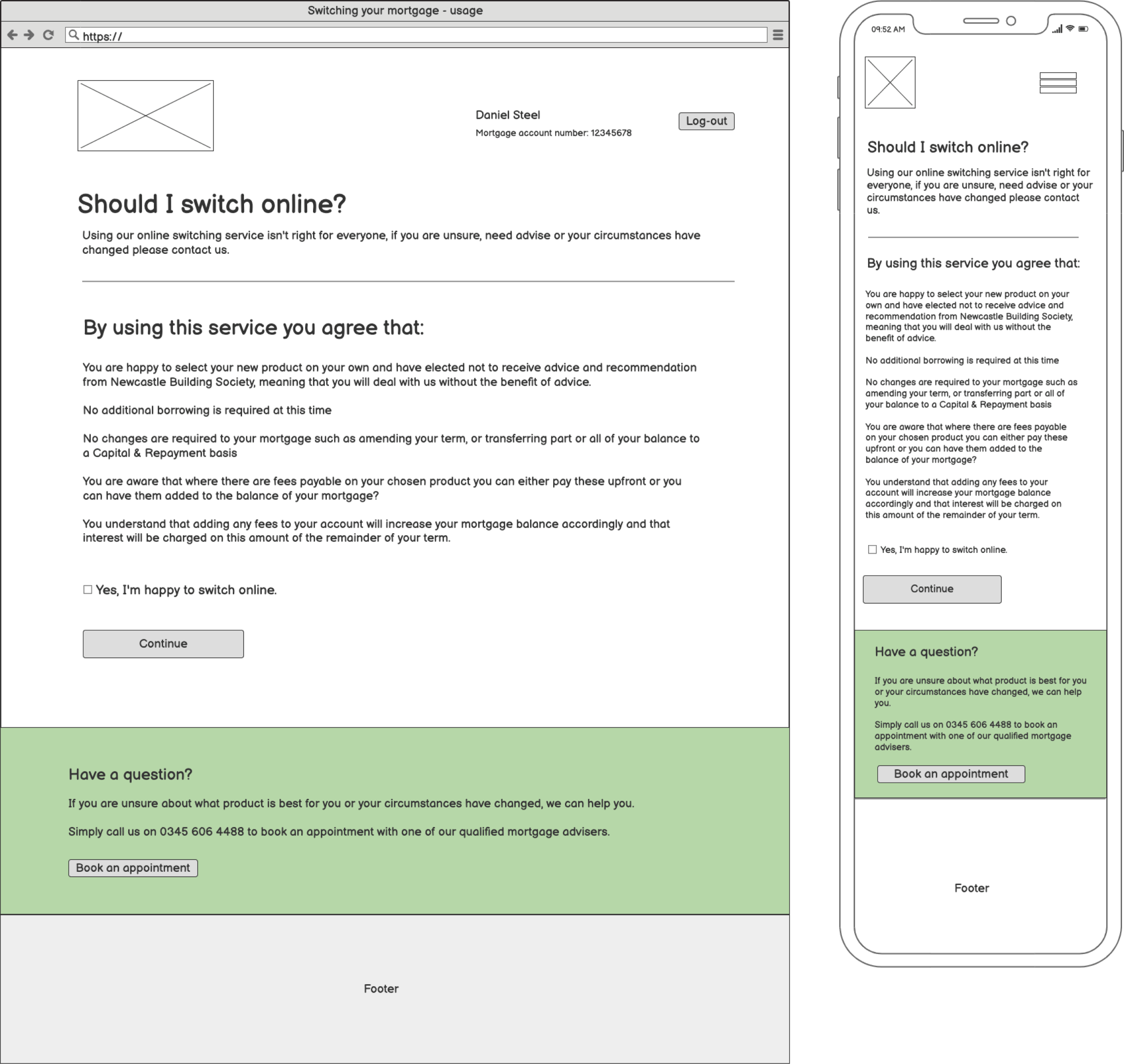

I created some low-fidelity wireframes to explore how this service may look. I choose to design low-fidelity at this stage because I wanted to generate lots of ideas quickly and focus on the content hierarchy.

The wireframes were informed by the research conducted earlier in the project and used the actual content taken from the system in development.

Wireframes created in Balsamiq.

PROTOTYPE

How will a customer use the service?

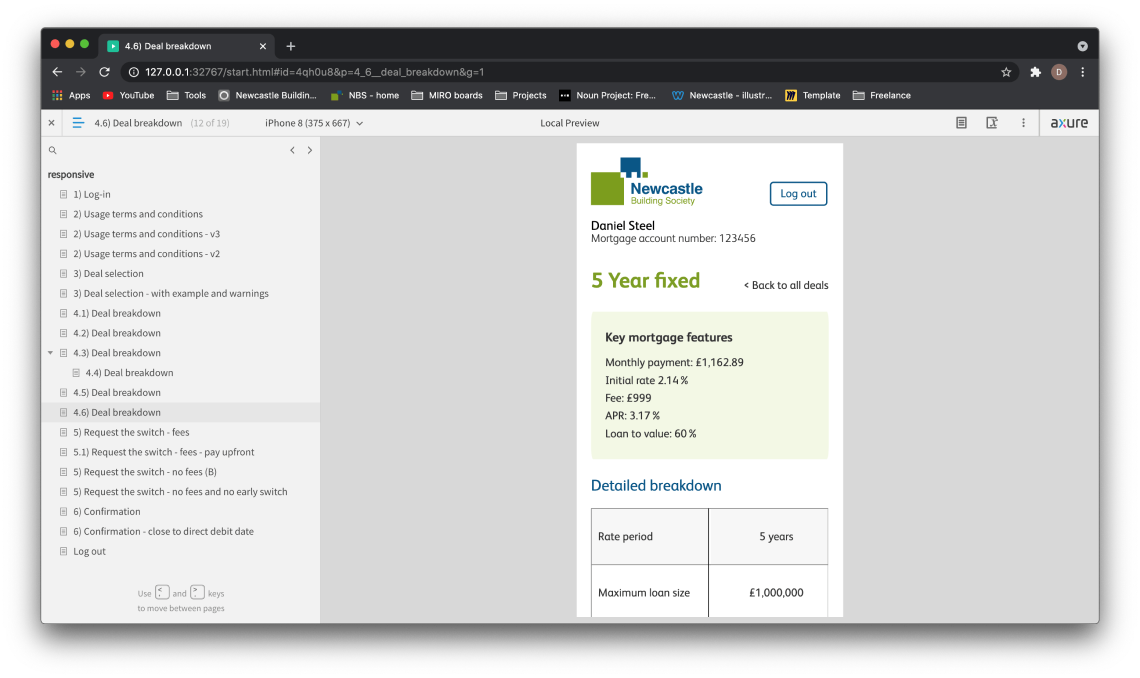

After sharing the wireframe concepts with the team and the business, I refined the wireframes into a high-fidelity clickable prototype. I created the prototype using Axure, it's a great piece of software that allows you to add validation to the inputs and selections to make the prototype feel like a real system. The prototype was responsive and worked across all screen sizes.

The high-fidelity prototype of the mortgage renewal service.

TESTING

Can our customers renew their mortgage using this service?

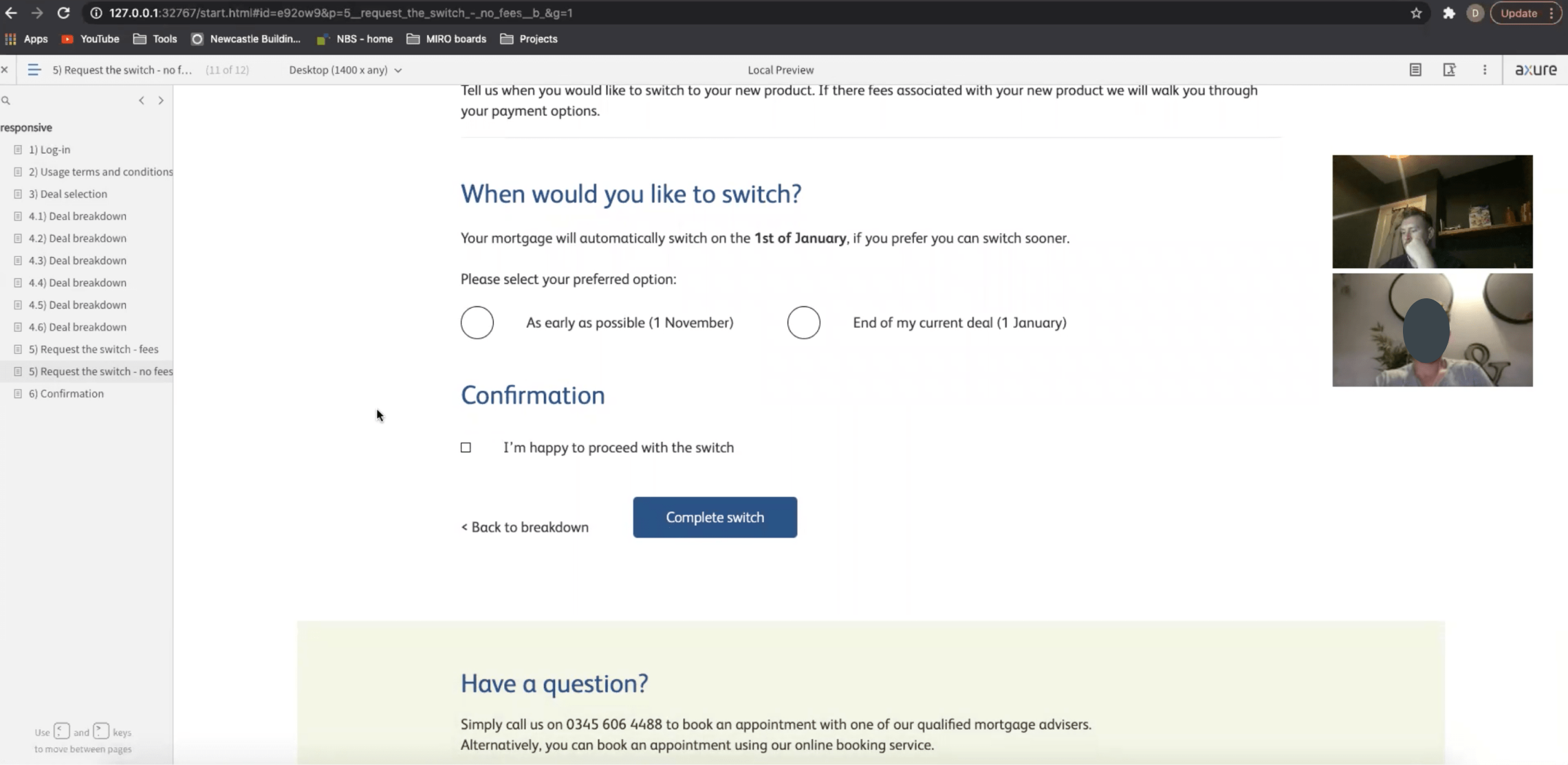

I conducted usability testing with eight customers. The purpose of the testing was to observe how real customers interacted with the prototype and determine whether they would use and trust this service. Another focus of the testing was the content. Would the customers have enough information to make an informed decision and choose the right mortgage for them?

The usability testing showed that customers could easily use the prototype to renew their mortgage. It revealed gaps and provided opportunities to improve. I used this insight to improve the prototype and added any changes/additions to the backlog for the developers to work on before the service was launched.

Key findings

- The usability study was very positive, with only one participant not being able to renew their mortgage using the prototype.

- When a participant couldn't find information, they stated that they would call us. If we are to reduce calls, some improvements to the content need to be made.

- Some of the information wasn't in the most beneficial position within the service, and at times, it was overlooked.

Usability testing the high-fidelity via Zoom

OUTCOME

Empowering the customer, securing business and reducing costs

The creation of this service means that customers can renew their mortgage online at a time that is convenient for them without leaving the house. The previous process required customers to call or visit a branch to renew their mortgage, this was inconvenient for the customer and expensive for the business. This new digital service will improve the customer experience and make efficiencies in the business.

Other work

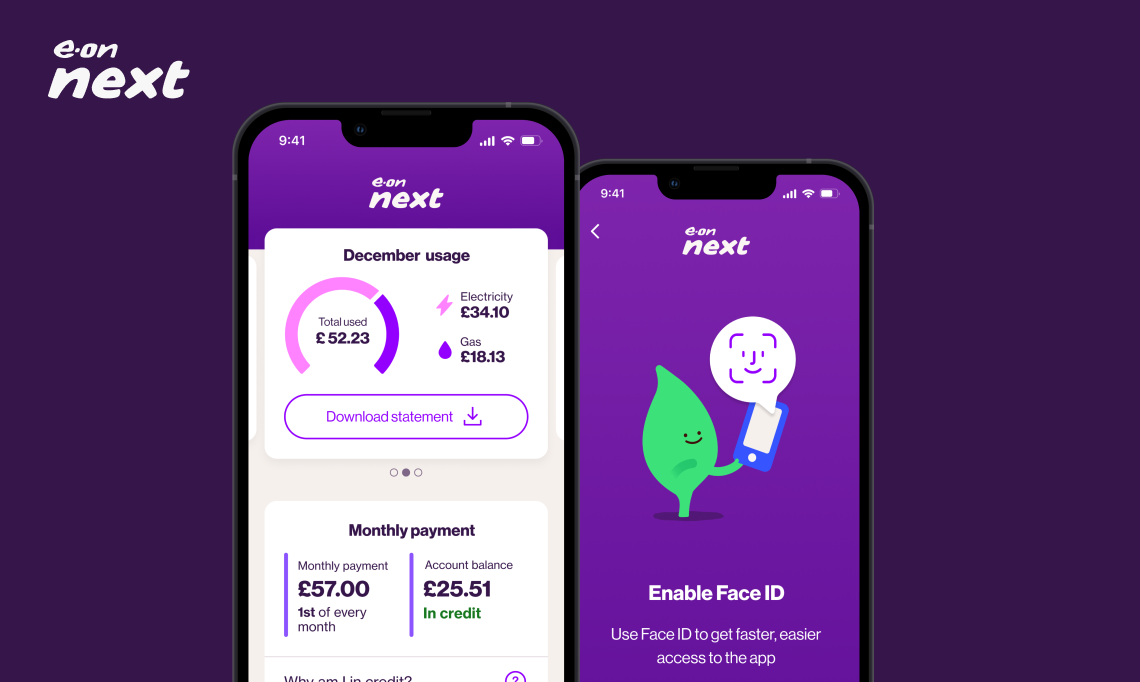

E-on NextMobile app

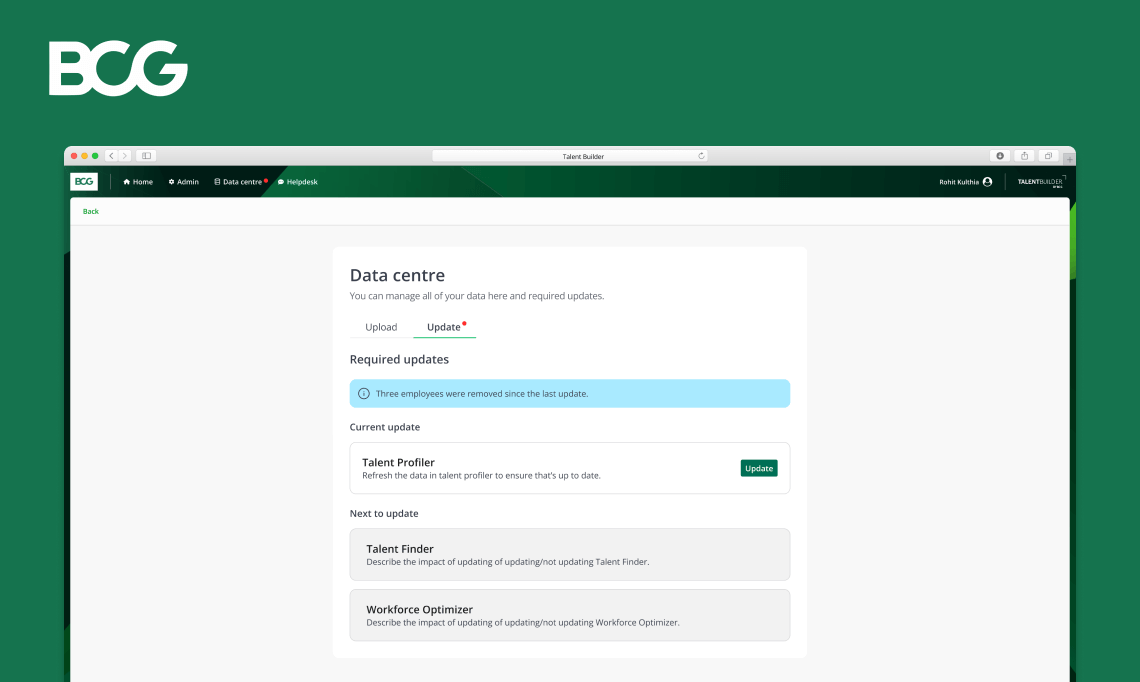

Talent BuilderSaaS

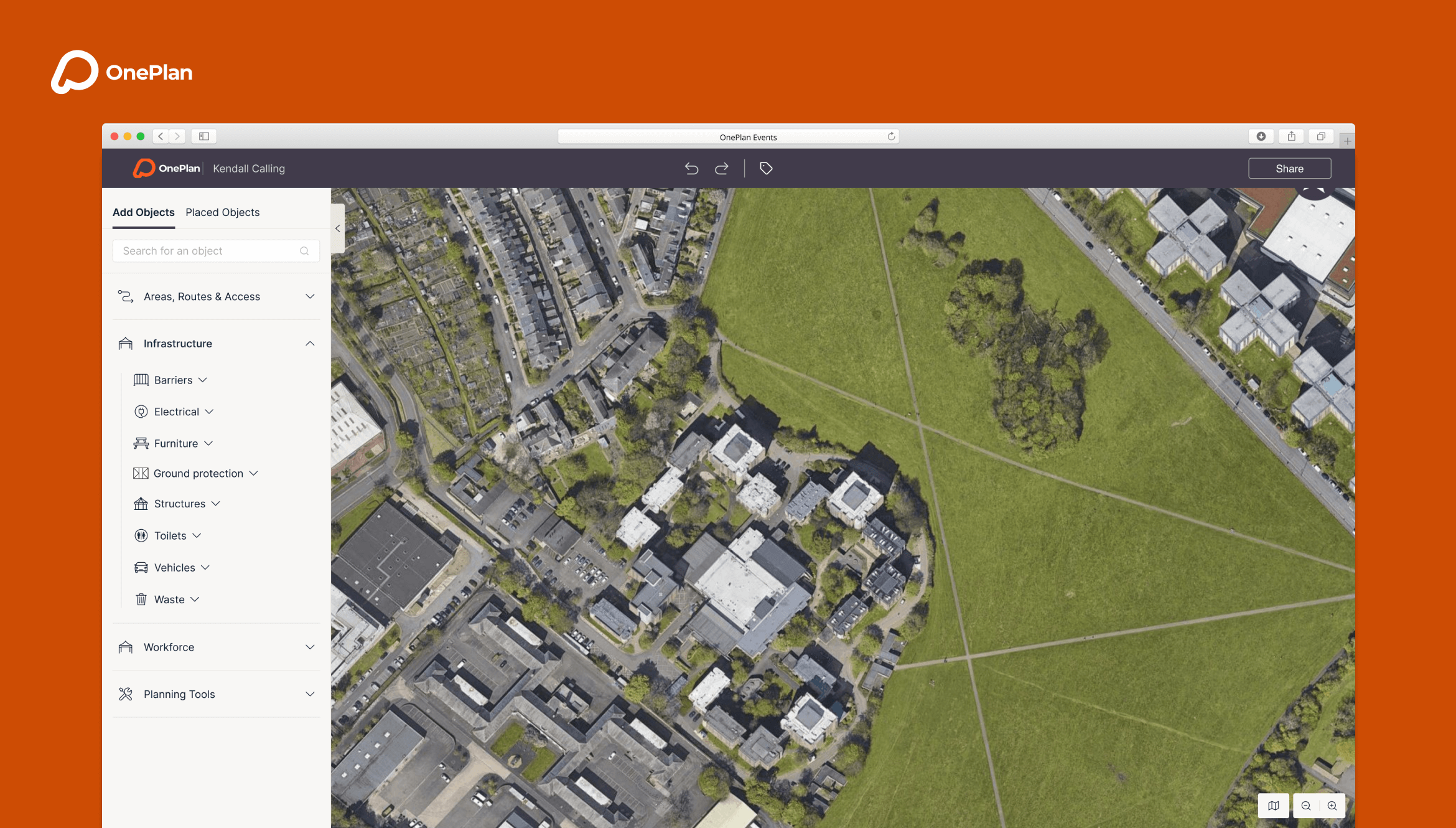

OnePlan EventsSaaS

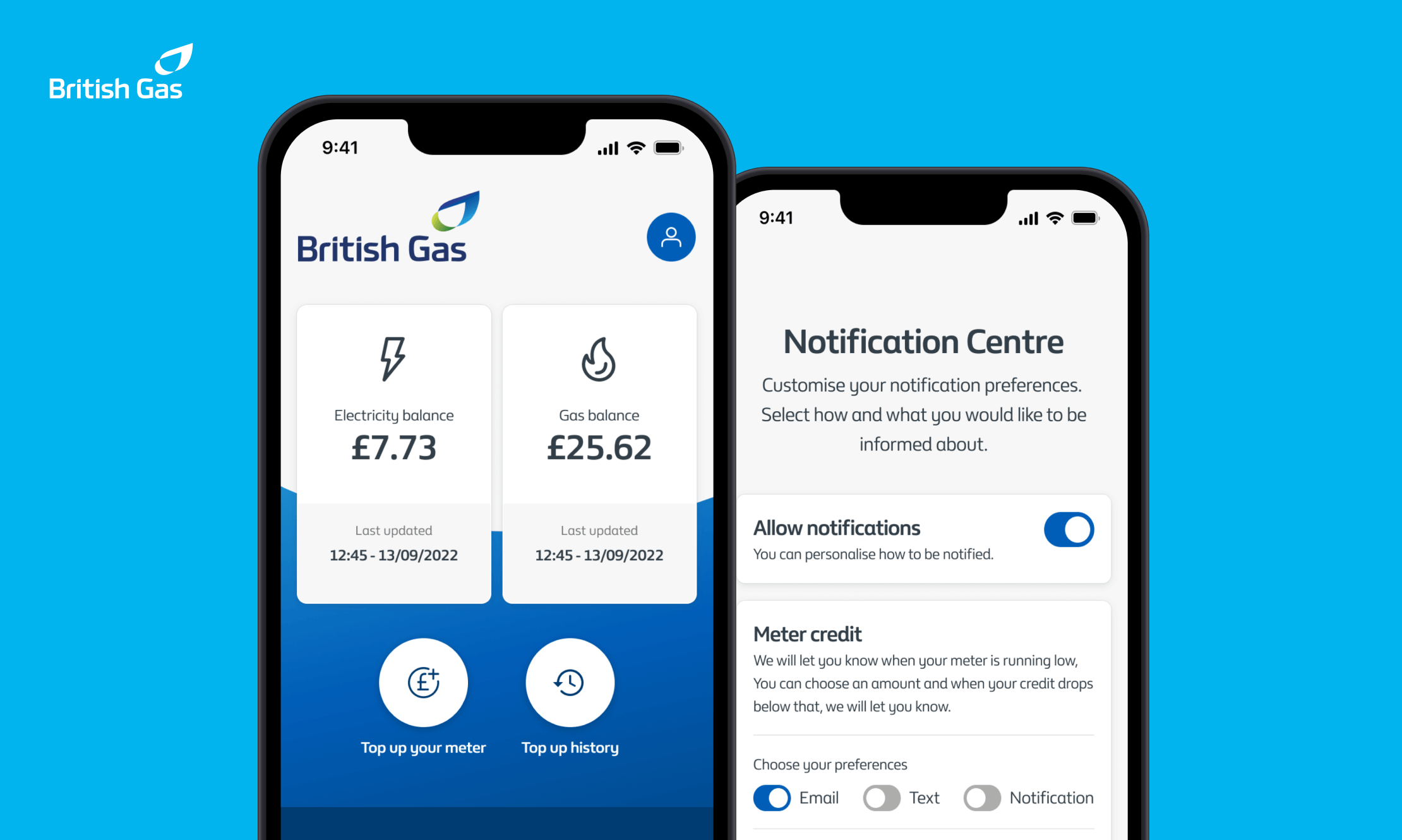

British GasMobile app

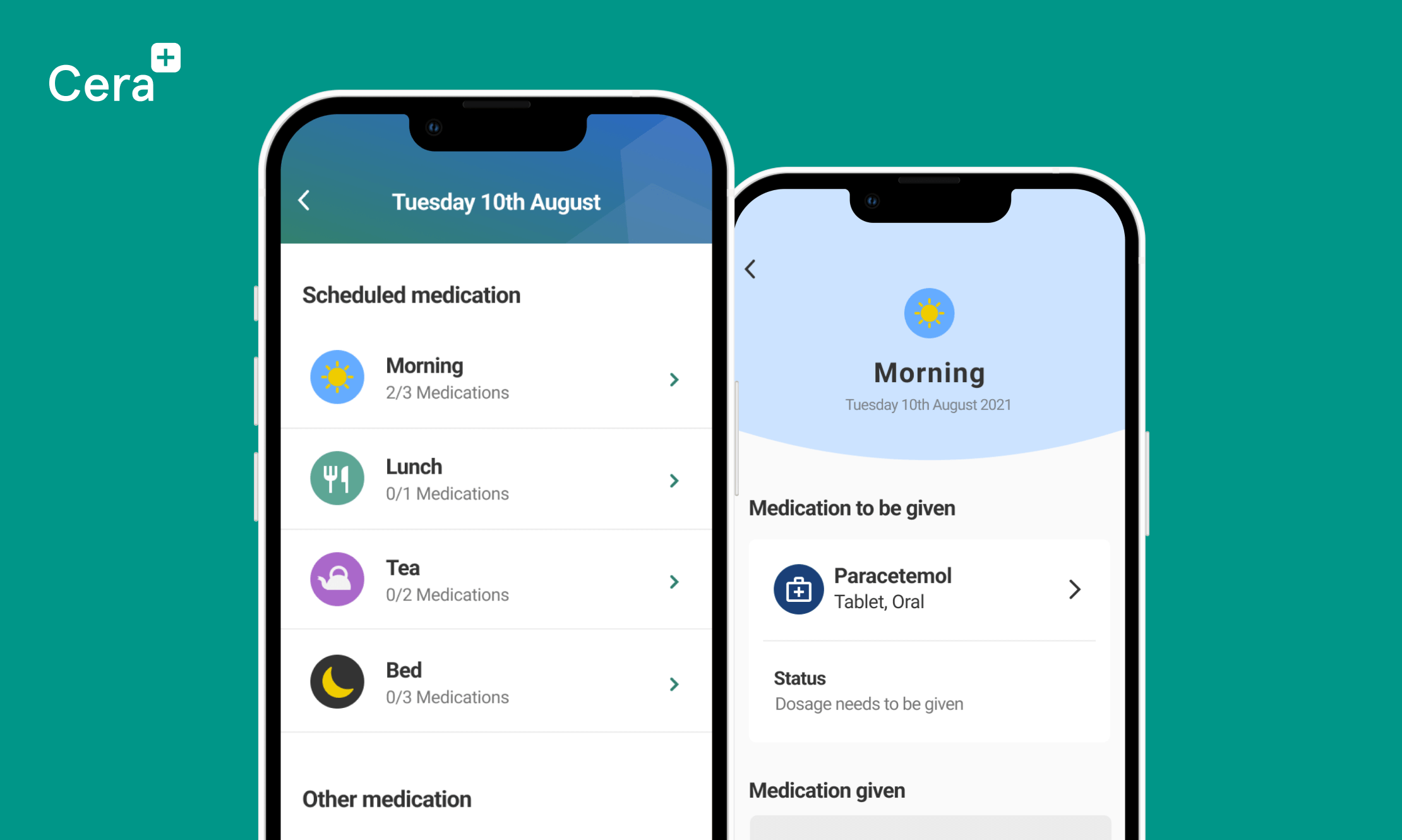

Cera CareMobile app

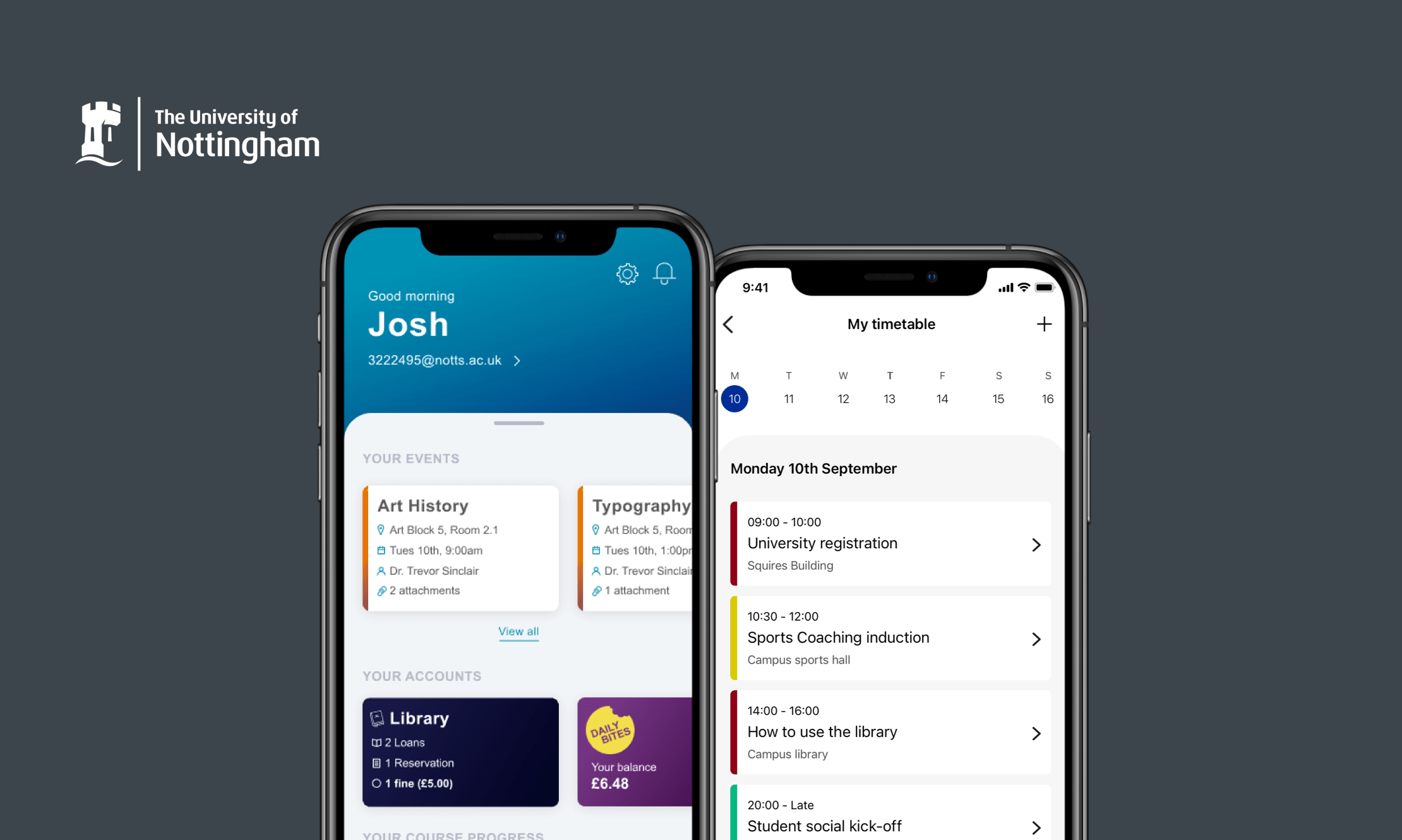

University of NottinghamMobile app